Life is unpredictable. A medical emergency, job loss, or car repair can strike at any moment—and if you’re not financially prepared, it can hit hard. That’s where an emergency money comes in. It’s your personal financial shield that helps you stay steady even when life gets rocky. In this post, we’ll explore why an emergency fund is important, how much you need, and smart strategies to build and allocate it effectively.

What is an Emergency Fund?

An emergency fund is a dedicated amount of money set aside for sudden and unexpected financial needs. This fund helps you avoid taking on high-interest debt or disrupting your long-term financial goals.

This fund should not be touched for regular expenses, shopping, or vacations. It is purely for true emergencies like:

-

- Job loss or pay cuts

-

- Medical emergencies

-

- Urgent home or car repairs

-

- Natural disasters or family crises

Why Emergency Fund is Important ?

-

- Prevents Debt Trap

The number one reason why an emergency fund is important is because it saves you from falling into debt. Instead of using a credit card or personal loan during emergencies, you’ll already have money ready.

-

- Reduces Stress & Anxiety

Financial stress is a major cause of anxiety. Having a financial backup gives you mental peace and allows you to handle tough situations calmly and confidently.

-

- Keeps Your Goals Intact

Without an emergency fund, you may end up breaking your fixed deposits or selling investments. That means compromising your long-term goals. A dedicated fund ensures your goals remain untouched.

-

- Supports During Job Loss

Job loss is unpredictable. During such times, your emergency fund acts as your temporary salary and gives you breathing space to look for a better opportunity without panic.

-

- Prepared for Health or Family Crises

Even if you have insurance, not everything is covered. Your emergency fund fills in the gaps and lets you focus on recovery rather than worrying about bills.

How Much Emergency savings Do You Need?

The amount of your emergency saving depends on your life stage and responsibilities. Here’s a simple rule:

Single/Unmarried Individuals: Minimum 6 months of basic living expenses

Married Individuals: 12 months of family expenses

Business Owners/Freelancers: Ideally 24 months, since income may be unstable

This includes rent/EMI, groceries, utilities, insurance premiums, child’s school fees, etc.

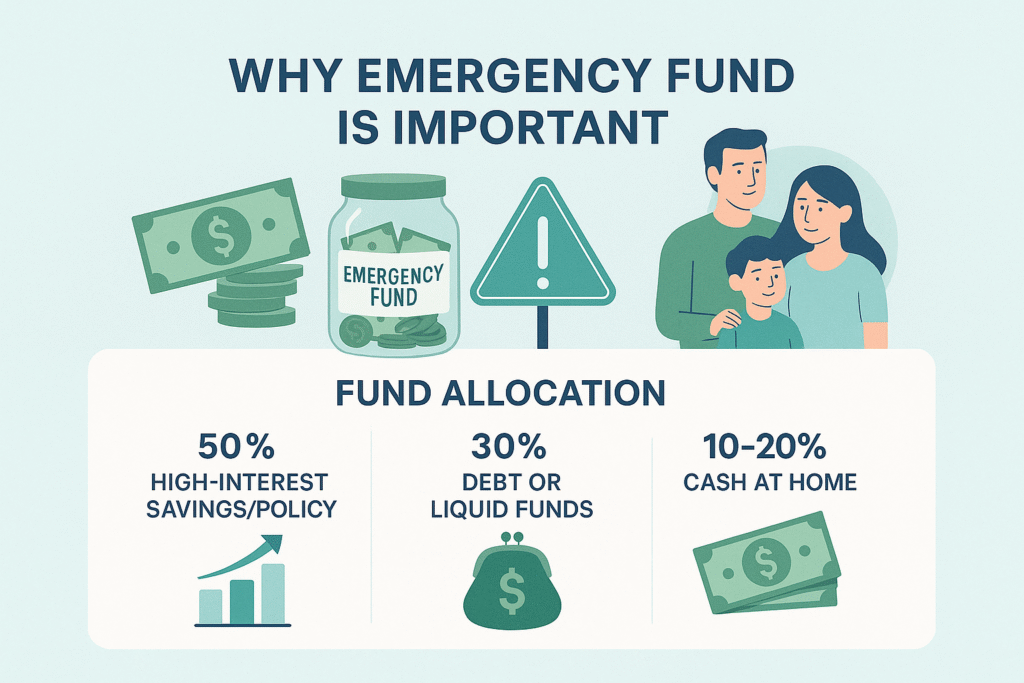

Where to Keep Your Emergency Fund? (Smart Allocation)

You don’t need to keep 100% of your emergency fund in one place. You can split it into safe, accessible, and slightly interest-earning options:

-

- 50% in High-Interest Savings Account or Guaranteed Return Policy :

Look for savings accounts or policies offering 6–7.5% annual interest. These accounts should offer instant withdrawal and no lock-in.

- 50% in High-Interest Savings Account or Guaranteed Return Policy :

-

- 30% in Debt Mutual Funds or Liquid Funds :

Debt funds are low-risk and offer better returns than savings accounts. Liquid funds provide quick access within 1–2 days and are great for parking emergency money.

- 30% in Debt Mutual Funds or Liquid Funds :

-

- 10–20% Cash at Home or in Locker :

Always keep a small percentage in hard cash for real emergencies like medical needs, ATM failure, or natural disasters where digital options may fail.

- 10–20% Cash at Home or in Locker :

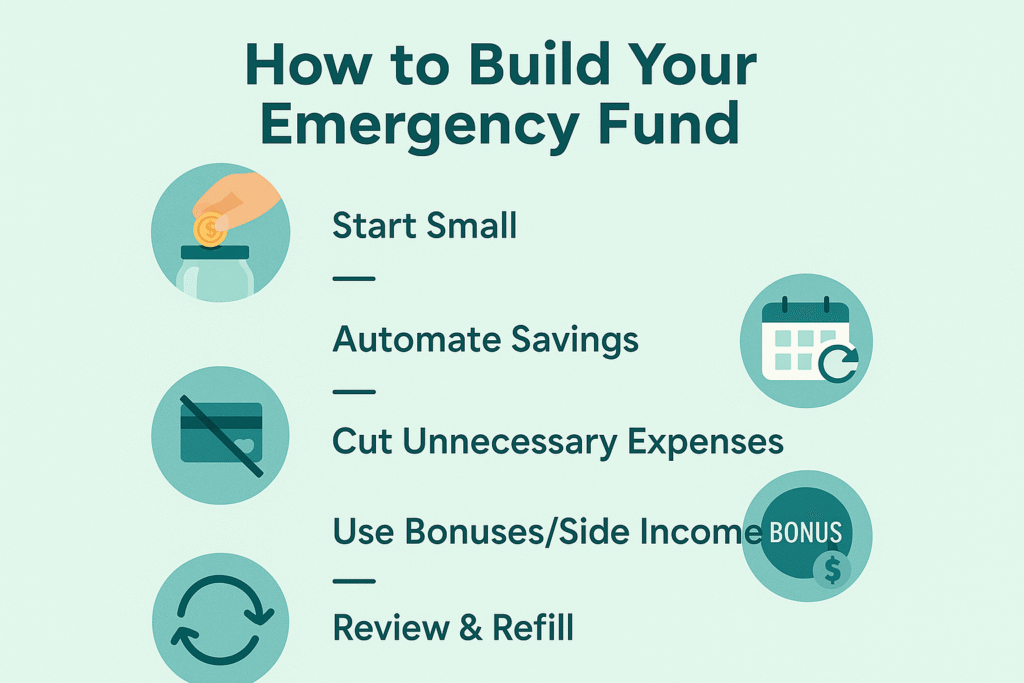

How to Build Your Emergency Fund ?

Begin with whatever you can—₹500 or ₹1,000 a month. Consistency is key

Set up an automatic transfer to your emergency fund account right after salary Credit. Treat it like a regular bill.

Track where your money goes. Cancel subscriptions you don’t use, eat out less, and redirect those savings to your emergency fund.

Any extra income—bonuses, freelance earnings, or cashback—can be directed to build your emergency reserve faster.

If you use any part of your emergency fund, make a plan to refill it within 1–3 months.

Common Mistakes to Avoid :

-

- Keeping all emergency money in cash or locked instruments

-

- Using your emergency fund for non-emergencies like shopping or travel

-

- Ignoring inflation while building the fund

-

- Delaying the process thinking you’ll “start next month”

Conclusion:

Now that you know why an emergency money is important, it’s time to take action. It’s not just about money—it’s about mental peace, security, and confidence. Whether you’re a salaried person, business owner, or homemaker, an emergency fund is your personal financial safety net.

Start today, plan wisely, and build your emergency cushion one step at a time. Because in life, it’s not about if an emergency will happen—it’s about when. And when it does, your emergency fund will be your biggest relief.