Why Retirement Planning Can’t Wait Anymore

There was a time when our parents could rely on fixed deposits (FDs) giving 10–11% interest, and that was enough to retire comfortably. Today, those same FDs offer only 6–7%, while inflation has surged to 7–8% or more. The money we save now loses value faster than ever.

As a financial advisor, I often get asked: “What’s the right age to start planning for retirement in India?” My honest answer is: The earlier, the better.

So the real question is: When should you start retirement planning?

my answer is simple:

The right time to start was yesterday. The next best time is today.

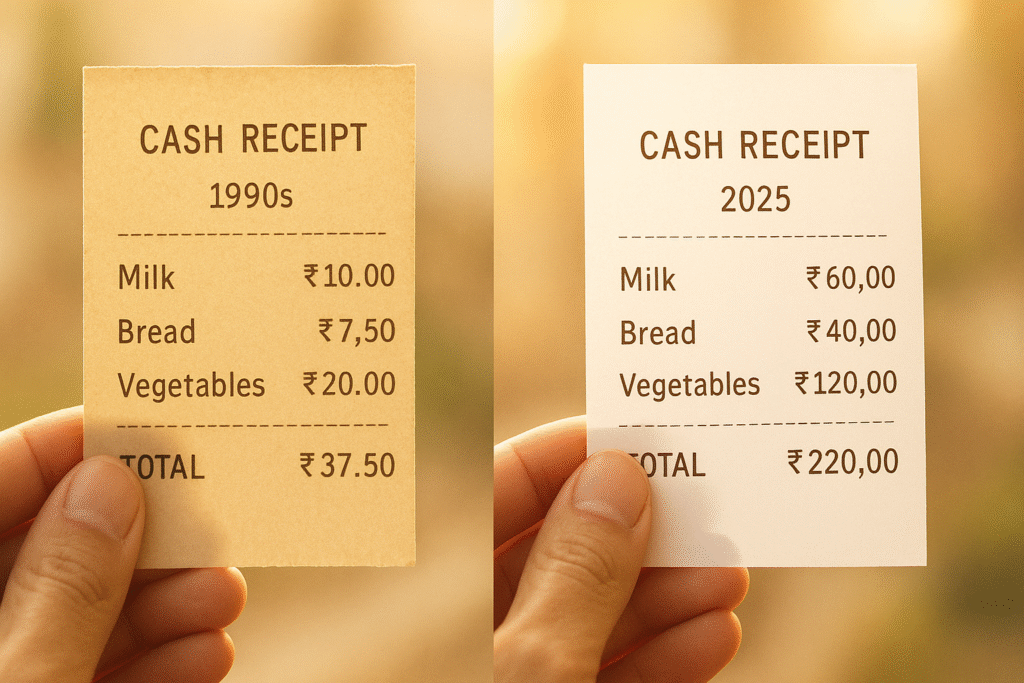

How Inflation Is Silently Eating Your Savings

Let’s take a simple example:

A packet of milk that cost ₹12 in 2000 now costs ₹60 or more.

A cylinder of LPG that was ₹200 is now ₹1,200+

Basic groceries that were ₹2,000/month now cost ₹6,000+ for a small family

That’s inflation. When prices rise every year, the same ₹100 buys fewer goods. If inflation is at 7–8% annually, and your FD returns are 6–7%, your real return is negative.

This means saving alone is not enough anymore.

You need a strategy that can beat inflation and give you financial freedom in retirement.

What Happens When You Delay Retirement Planning

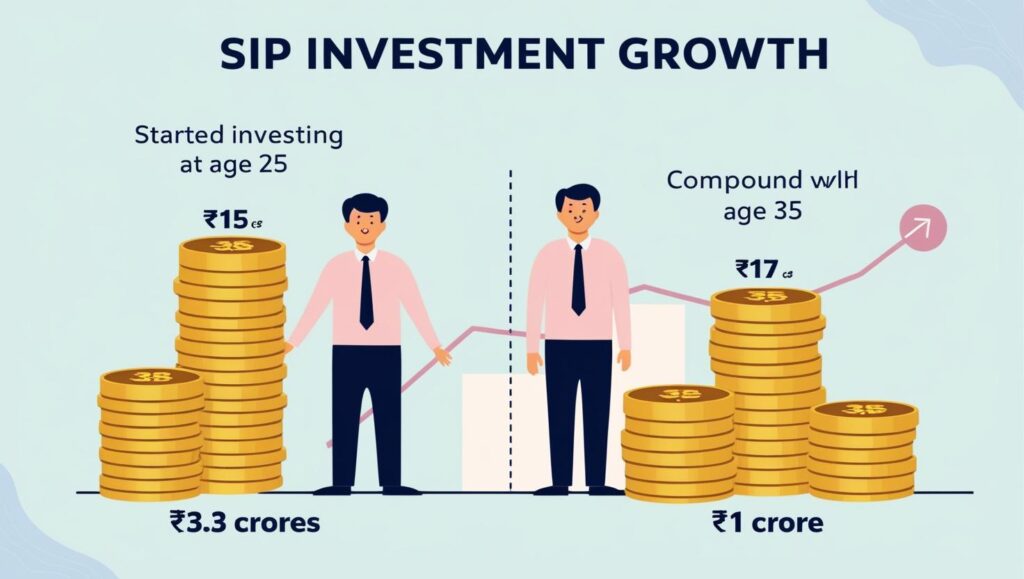

Let’s compare two individuals:

-

- Person A starts at age 25, investing ₹5,000/month in a SIP

-

- Person B starts at age 35, same amount

Both invest until age 60 with an average 12% annual return

Results:

- Person A ends up with over ₹3.3 Crores

- Person B ends up with just ₹1 Crore

A 10-year delay results in a ₹2.3 Crore loss—because of lost compounding.

Your Best Tools for Retirement Planning in India :

As a financial advisor, here’s what I recommend:

1 . Systematic Investment Plans (SIPs)

SIPs in mutual funds are ideal for long-term goals like retirement:

-

- Start with as little as ₹500/month

-

- Historically deliver 8–12% returns annually

-

- Rupee-cost averaging reduces market risk

-

- Power of compounding works best when you start early

Tip: Increase your SIP by 10% every year as your income grows.

2 . LIC Pension Plans – For Assured Lifetime Income

If you prefer guaranteed income after retirement, LIC’s pension plans are excellent.

Two Three choices:

LIC Jeevan Akshay VII

-

- Immediate annuity plan

-

- Pay a lump sum once, start receiving monthly/quarterly pension

-

- Lifetime income guaranteed

-

- Choose single life or joint life

-

- Ideal if you’re close to retirement and want regular income

LIC New Jeevan Shanti

-

- Deferred annuity plan

-

- Pay once, pension starts after 5–20 years (your choice)

-

- Income guaranteed for life

-

- Ideal for those in their 40s–50s who want to plan early

-

- Joint life option available for spouse security

LIC Pension Plan Benefits

-

- 100% guaranteed pension for life

-

- No market risk

-

- Suitable for conservative investors

-

- Backed by LIC & Government of India

-

- Flexible payout options (monthly, quarterly, yearly)

What I Recommend Based on Your Age Group

-

- Start SIPs as early as possible

-

- LIC pension plan or saving plan

-

- Don’t wait to earn more — start small, stay regular

-

- Combine SIPs with LIC New Jeevan Shanti for deferred pension

-

- Increase your SIP amount to accelerate wealth

-

- Use lump sum in LIC Jeevan Akshay VII for lifetime monthly income

-

- Prioritize health insurance & stable income

Conclusion: Start Retirement Planning Before It’s Too Late

Retirement is not about age — it’s about preparation. If you want to live peacefully, without depending on others, you need a plan that protects you from inflation and rising expenses.

The combination of :

SIP for growth, and LIC Pension Plans for safety

offers a balanced strategy for every age.

You don’t have to be rich to retire well — you just have to start early.

Let’s stay Connected

If you found this blog helpful, follow me for more insights on retirement planning, smart investments, LIC pension plans, and personal finance tips tailored for Indian investors.

I regularly share easy-to-understand guides to help you make better financial decisions.

Don’t miss out—stay informed and take charge of your financial future today!

Follow me on Instagram and LinkedIn for regular updates, reels, and easy-to-understand financial content that helps you plan your future better.

Let’s build a secure tomorrow—starting today!