Introduction: LIC vs Mutual Fund – The Big Confusion

When it comes to planning your finances, the debate between LIC vs Mutual Fund is a common one. Many people wonder: Should I invest in LIC for safety, or mutual funds for higher returns? The truth is, both serve different purposes. LIC is primarily an insurance tool with some savings benefit, while mutual funds are pure investment vehicles aimed at wealth creation. In this blog, we’ll break down the difference, clear common misconceptions, and help you choose what’s better for your goals.

What is LIC?

LIC (Life Insurance Corporation of India) is a government-owned insurance company that offers life insurance policies. Over the decades, LIC has become synonymous with trust, especially among traditional Indian families.

Popular LIC Plans:

- Endowment Policies – Insurance + guaranteed savings.

- Term Insurance – Pure life cover without returns.

- ULIPs (Unit Linked Insurance Plans) – Market-linked insurance.

LIC is designed to provide life cover, ensuring your family is financially protected in case of your untimely death. Some plans also help you build a corpus through bonuses or maturity benefits.

What is a Mutual Fund?

A Mutual Fund pools money from various investors and invests it in equities, bonds, or other securities, managed by professional fund managers. The aim is to generate higher returns based on market performance.

Types of Mutual Funds:

- Equity Funds – Invest in stocks (higher risk, higher return).

- Debt Funds – Invest in bonds (low risk, stable return).

- Hybrid Funds – A mix of equity and debt.

Unlike LIC, mutual funds do not offer any insurance. Their sole purpose is investment and wealth creation, especially when done long-term.

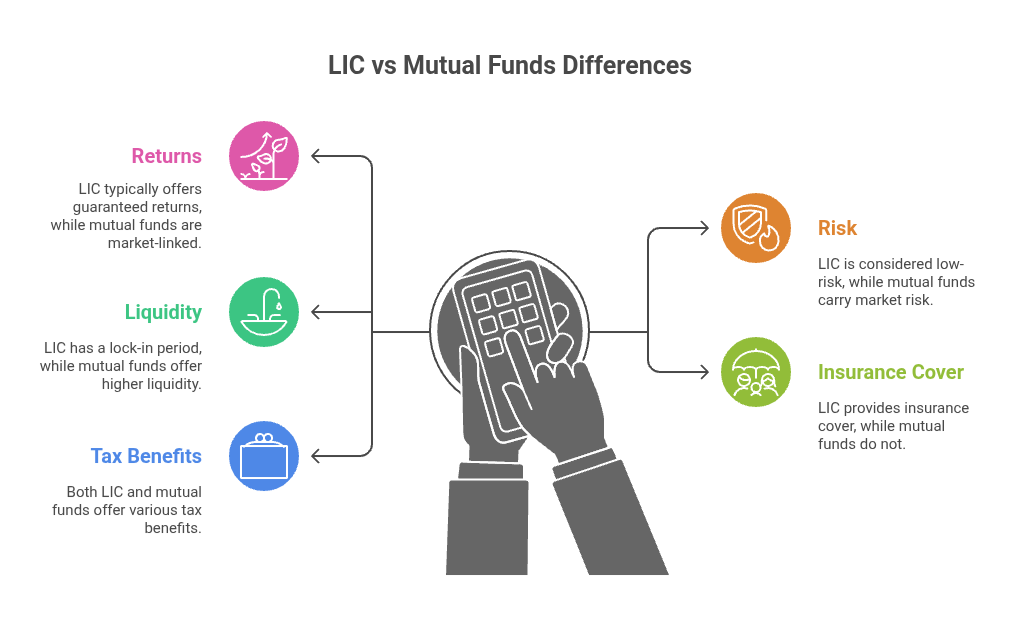

Key Differences Between LIC and Mutual Funds

Here’s a simple comparison table to help you understand better:

| Feature | LIC | Mutual Fund |

| Purpose | Lic Insurance +Savings | Wealth Creation |

| Return Type | Guaranteed or low returns(6-8%) | Market-linked(Can be 10%+long term) |

| Risk | Very Low | Moderate to high |

| Lock-in Period | Long(5-20 years) | Can be Short(1-3 years) |

| Liquidity | Low (Surrender Charges apply) | High (Can be redeem any time) |

| Tax Benefits | Yes(Under 80C & 10(10D) | Yes (ELSS under 80C,LTCG benefits) |

| Insurance Cover | Yes | No |

| Ideal for | Risk-averse, long-term planners | Growth-oriented investors |

Who Should Choose LIC?

LIC is ideal for those who:

- Need life insurance for family protection.

- Prefer guaranteed returns over market risk.

- Want forced savings with long-term discipline.

- Are not comfortable with digital/market-based platforms.

- Are nearing retirement and want security.

Example:

A 45-year-old parent who is the sole breadwinner may choose LIC to ensure that their family’s future is secure if something happens to them.

Who Should Choose Mutual Funds?

Mutual Funds are better suited for :

- Individuals with a medium to high risk appetite.

- Young professionals looking to build long-term wealth.

- People already covered under term insurance.

- Investors who understand or want to learn about markets.

- Those wanting tax benefits with potential growth (via ELSS).

Example :

A 30-year-old software engineer may invest in a SIP (Systematic Investment Plan) in equity mutual funds to grow wealth for future goals like a home or retirement.

Common Misconceptions

1. “LIC gives better returns.”

Reality:

LIC is not designed for high returns—it’s for protection and guaranteed savings. Long-term mutual funds often outperform LIC policies.

2. “Mutual funds are risky or like gambling.”

Reality:

Risk in mutual funds depends on the fund type. Debt and hybrid funds have lower risk. Plus, long-term SIPs average out volatility.

3. “You don’t need insurance if you have mutual funds.”

Reality:

You should always have term insurance separately from investments.

Can You Invest in Both?

Absolutely, and in fact, you should!

Absolutely, and in fact, you should!

- Term Insurance from LIC (or any insurer) – Low premium, high cover.

- Mutual Funds for investment – SIPs in diversified funds for long-term growth.

This strategy ensures:

- Financial protection for your family.

- Higher wealth creation potential through mutual funds.

Real-Life Scenario Illustration

Let’s look at a simplified illustration:

Rahul (Age 30) wants to plan for his daughter’s education after 15 years. He has two options:

Option 1 : LIC Endowment Policy

- Investment: ₹5,000/month

- Maturity: ₹12 lakhs approx.

- Insurance cover: ₹10 lakhs

- Return Rate: ~5%

Option 2: Term Insurance + Mutual Fund SIP

- Term Plan: ₹500/month → ₹1 crore cover

- Mutual Fund SIP: ₹4,500/month

- Potential Corpus after 15 years: ₹25–30 lakhs (at 12% CAGR)

- Return Rate: ~12%

Clearly, Option 2 gives better financial protection and wealth creation.

Final Verdict: LIC vs Mutual Fund – Which is Better?

It all depends on your goals, risk tolerance, and financial planning.

- Choose LIC if you want safety, guaranteed maturity, and insurance in one.

- Choose Mutual Funds if you want better long-term returns and already have life insurance.

Best: Combine both wisely – Take term insurance + invest in mutual funds.

Bonus Tips for Investors:

- Always review your financial plan annually.

- Use a term plan for protection, not investment.

- Start a SIP early – even ₹500/month matters.

- Use online calculators to plan goals.

- Consult a certified financial advisor if confused.

Conclusion:

The LIC vs Mutual Fund debate doesn’t have one clear winner. It’s about picking the right tool for the right job. If you understand your needs, you can smartly use both to build a financially secure and prosperous future.

Ready to Make a Smart Financial Decision?

Now that you understand the difference between LIC vs Mutual Fund, take the next step toward building your secure and prosperous future.

Need help choosing the right plan?

Let’s create a personalized plan for you.

Book Your Free Consultation today!

Don’t wait. Your future won’t build itself—start today!

You Might Also Like:

Why HDFC ERGO Optima Secure Is Better Than Other Health Insurance Plans in 2025 (3X Coverage Explained)

In 2025, choosing the right health insurance plan means more than just comparing premiums. You...

What Happens If You Stop Paying LIC Premiums in 2025? Full Guide for Policyholders

LIC (Life Insurance Corporation of India) policies are a long-term commitment to securing your family’s...

Why Term Insurance Is Must for Young Families ?

“If something happens to me… will my family be okay?” This silent question lives in...

LIC vs Mutual Fund – Which is Better for Your Financial Goals?

Introduction: LIC vs Mutual Fund – The Big Confusion When it comes to planning your...

𝐖𝐡𝐢𝐜𝐡 𝐇𝐞𝐚𝐥𝐭𝐡 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐢𝐬 𝐁𝐞𝐬𝐭 𝐟𝐨𝐫 𝐅𝐚𝐦𝐢𝐥𝐲 𝐢𝐧 𝐈𝐧𝐝𝐢𝐚? [𝟐𝟎𝟐𝟓 𝐆𝐮𝐢𝐝𝐞]

In today’s fast-paced world, health emergencies can come unannounced, and the last thing any family...

𝗪𝗵𝗮𝘁 𝗜𝘀 𝘁𝗵𝗲 𝗥𝗶𝗴𝗵𝘁 𝗔𝗴𝗲 𝘁𝗼 𝗦𝘁𝗮𝗿𝘁 𝗣𝗹𝗮𝗻𝗻𝗶𝗻𝗴 𝗳𝗼𝗿 𝗥𝗲𝘁𝗶𝗿𝗲𝗺𝗲𝗻𝘁? 𝗦𝗼𝗼𝗻𝗲𝗿 𝗧𝗵𝗮𝗻 𝗬𝗼𝘂 𝗧𝗵𝗶𝗻𝗸!

Why Retirement Planning Can’t Wait Anymore There was a time when our parents could rely...