LIC (Life Insurance Corporation of India) policies are a long-term commitment to securing your family’s financial future. But sometimes, due to unforeseen financial challenges or oversight, policyholders may miss paying their premiums. If you’ve recently taken an LIC policy or plan to do so in 2025, it’s crucial to understand the consequences of stopping premium payments and the available solutions.

This blog explains what happens if you stop paying your LIC premium in 2025, including updated rules, revival options, and more.

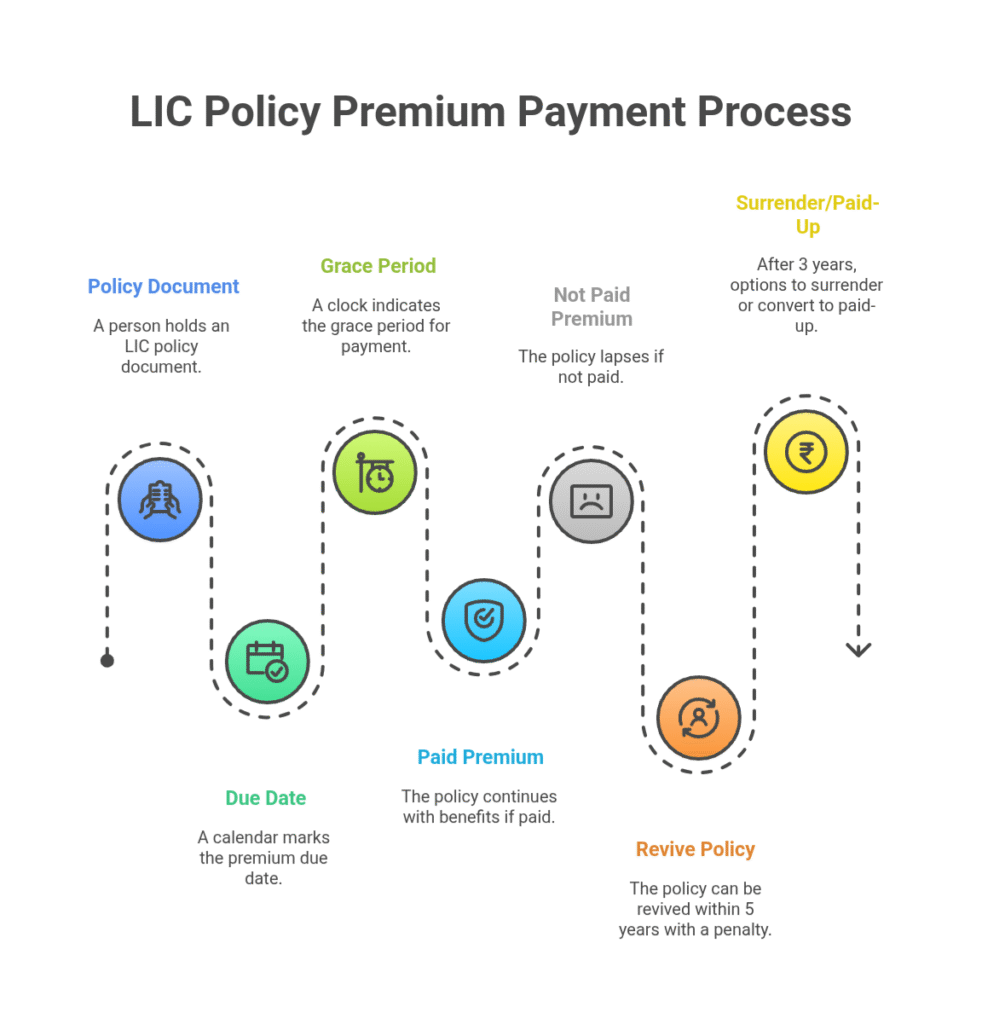

1 . LIC Premium Grace Period (2025 Update)

LIC provides a grace period to all policyholders after the premium due date. This grace period ensures that minor delays don’t disrupt your policy.

Monthly mode: 15 days grace period

Quarterly, Half-Yearly, and Yearly mode: 30 days grace period

✅ If you pay the premium within the grace period, your policy continues without any late fees or penalties.

✅ Even if you pay after the grace period, your policy can still be continued by paying the outstanding premium along with a small penalty or late fee.

2. What If You Don’t Pay After the Grace Period?

If you fail to pay the premium even after the grace period, the policy will be marked as lapsed. This means:

- Insurance coverage stops

- You’re no longer eligible for bonuses

- Death benefits will not be paid during the lapse period

- You lose all policy benefits unless you take action

3 . LIC Revival Option – You Can Get It Back!

The good news is that LIC allows policyholders to revive their lapsed policies within 5 years from the date of the first unpaid premium.

✅ Here’s what you need to do:

- Pay all pending premiums + interest

- Undergo a health check-up (if required)

- Fill a revival form through your LIC advisor or online

LIC also runs revival campaigns from time to time, offering relaxation on penalties or medical tests. These campaigns are great opportunities to bring your policy back to life with less hassle.

4 . What Happens to the Money You Paid?

LIC protects long-term investors. What happens depends on how many years you paid before stopping:

✔ If you paid less than 3 years:

- The policy is terminated

- No benefits or refund (except in return-of-premium plans)

✔ If you paid 3 years or more:

- Your policy becomes paid-up

- A reduced paid-up value is calculated and given at maturity or death

- No further premiums are required

- No future bonuses are added

In 2025, this “one-year withdrawal or surrender” rule applies only to very specific types of plans. For regular traditional plans, surrender is still available only after 3 years of full premium payments.

5 . New LIC Rule in 2025 – Know This

For new LIC policies issued in 2025, LIC has revised certain terms. One key update is that:

Surrender or withdrawal after just one year is available only under select single-premium or special products.

For most traditional policies, you still need to pay premiums for at least 3 years to receive any surrender value.

So, if you’re taking a policy now, ask your LIC advisor for exact surrender rules as per your plan.

6 . Why Paying Premiums on Time Is Important

- You maintain full insurance protection for your family

- You receive all loyalty and reversionary bonuses

- You avoid revival penalties and medical tests

- You maintain a good track record for future plans or loans against policy

7 . Tips to Never Miss a Premium Again

- Set auto-debit from your bank

- Use the LIC mobile app or website for reminders

- Link to Bharat BillPay or your UPI apps

- Pay annually or half-yearly to reduce chances of forgetting

Link to: “LIC premium payment options and tips”

Conclusion :

Stopping your LIC premium may lead to policy lapse, loss of cover, and missed benefits—but it’s not the end. In 2025, LIC continues to offer flexibility with grace periods, revival options, and clear guidelines. If you’ve missed a premium, act quickly. The sooner you revive or regularize your policy, the better protected your family remains.

📞 Need Help Reviving or Understanding Your Policy?

I’m an LIC advisor and here to help. Whether you’ve missed a payment or want to know the best options for your policy, reach out now.

📩 Dm me or book Your FREE policy review and support.

you may also like

Why HDFC ERGO Optima Secure Is Better Than Other Health Insurance Plans in 2025 (3X Coverage Explained)

Suhasini MIn 2025, choosing the right health insurance plan means more than just comparing premiums. You...

What Happens If You Stop Paying LIC Premiums in 2025? Full Guide for Policyholders

Suhasini MLIC (Life Insurance Corporation of India) policies are a long-term commitment to securing your family’s...

Why Term Insurance Is Must for Young Families ?

Suhasini M“If something happens to me… will my family be okay?” This silent question lives in...

LIC vs Mutual Fund – Which is Better for Your Financial Goals?

Suhasini MIntroduction: LIC vs Mutual Fund – The Big Confusion When it comes to planning your...

𝐖𝐡𝐢𝐜𝐡 𝐇𝐞𝐚𝐥𝐭𝐡 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐢𝐬 𝐁𝐞𝐬𝐭 𝐟𝐨𝐫 𝐅𝐚𝐦𝐢𝐥𝐲 𝐢𝐧 𝐈𝐧𝐝𝐢𝐚? [𝟐𝟎𝟐𝟓 𝐆𝐮𝐢𝐝𝐞]

Suhasini MIn today’s fast-paced world, health emergencies can come unannounced, and the last thing any family...

𝗪𝗵𝗮𝘁 𝗜𝘀 𝘁𝗵𝗲 𝗥𝗶𝗴𝗵𝘁 𝗔𝗴𝗲 𝘁𝗼 𝗦𝘁𝗮𝗿𝘁 𝗣𝗹𝗮𝗻𝗻𝗶𝗻𝗴 𝗳𝗼𝗿 𝗥𝗲𝘁𝗶𝗿𝗲𝗺𝗲𝗻𝘁? 𝗦𝗼𝗼𝗻𝗲𝗿 𝗧𝗵𝗮𝗻 𝗬𝗼𝘂 𝗧𝗵𝗶𝗻𝗸!

Suhasini MWhy Retirement Planning Can’t Wait Anymore There was a time when our parents could rely...