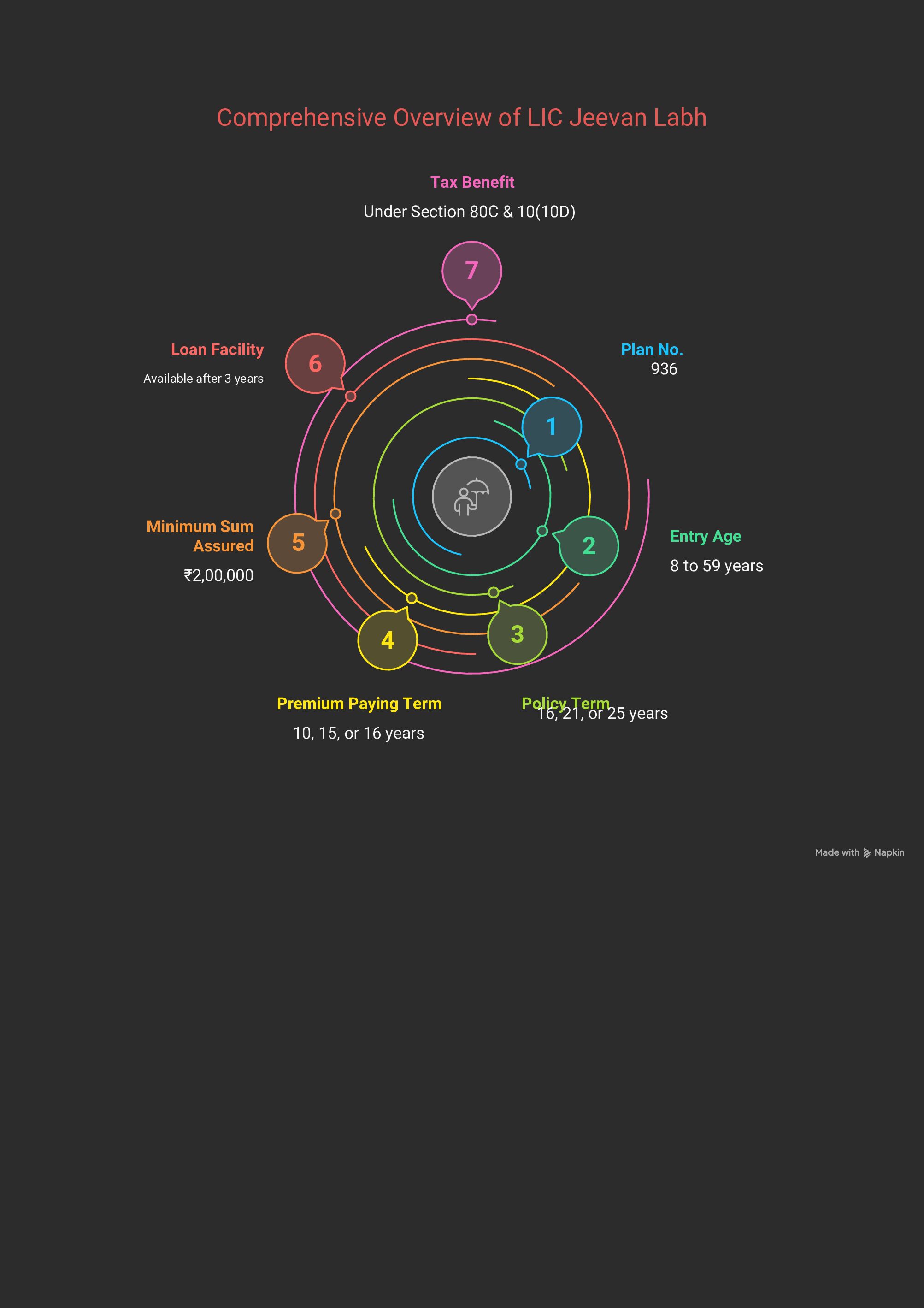

Are you looking for a reliable savings-cum-insurance plan that secures your family’s future and offers attractive tax benefits? LIC Jeevan Labh (Plan No. 936) could be the right choice for you. Here’s everything you need to know about the LIC Jeevan Labh Plan in 2025.

What is LIC Jeevan Labh?

LIC Jeevan Labh is a limited premium, non-linked, participating endowment plan, designed to provide both life cover and savings benefits. The plan allows you to secure your family’s future while accumulating a corpus for your long-term financial goals. It is an ideal plan for individuals looking for risk-free returns and a mix of insurance and investment.

The LIC Jeevan Labh Plan offers:

- A shorter premium term, meaning you can finish paying premiums sooner.

- Life cover plus savings, ensuring financial protection and investment growth.

- Tax-saving benefits, allowing you to save on taxes under sections 80C and 10(10D) of the Income Tax Act.

Key Features

The Ultimate Guide to LIC Jeevan Labh Plan – Features, Benefits & Returns :

LIC Jeevan Labh is known for its flexible premium options and long-term security. Here’s an in-depth look at its key features:

Limited premium paying term: You pay premiums for a limited period, ensuring a shorter commitment while benefiting from the plan’s life coverage and savings component.

Participation in bonuses: The policy participates in the corporation’s profit-sharing scheme, allowing you to receive bonus benefits over time.

Comprehensive coverage: The policy combines risk protection and savings growth, making it a suitable option for a wide range of individuals, from young professionals to parents planning for their children’s future.

Benefits of LIC Jeevan Labh

Here’s a deeper dive into the major benefits of choosing LIC Jeevan Labh in 2025:

- Maturity Benefit:

Upon completing the policy term, you receive the Sum Assured on Maturity plus any bonuses accumulated over the years. This ensures that you not only get life cover but also a financial cushion for your future needs.

- Death Benefit :

In case of the policyholder’s unfortunate death during the term, the family receives Sum Assured on Death, Reversionary Bonuses, and Final Bonus (if applicable). This provides a significant financial security net for your loved ones.

- Riders for Extra Protection:

You can add riders like Accidental Death, Disability, or Term Rider to enhance the coverage, providing you with additional protection tailored to your specific needs.

- Tax Savings:

Enjoy tax benefits under Section 80C for premiums paid and Section 10(10D) for the death and maturity benefits received. This plan is not only a great investment but also a tool for reducing your tax liabilities.

Example: ₹5 Lakhs Sum Assured

if you choose a ₹5 Lakh Sum Assured under the LIC Jeevan Labh Plan, your final maturity amount will depend on LIC’s bonus rates, which are projected to add substantial value to the sum assured. This makes it an attractive choice for long-term wealth creation and security.

Projected bonuses are subject to change based on LIC’s declared rates.

*Includes projected bonuses. Final maturity depends on LIC’s bonus rates.

Is LIC Jeevan Labh Right for You in 2025?

Many policyholders prefer the LIC Jeevan Labh Plan for it simplicity, transparency, and consistent bonus payouts.

Choose this plan if you are:

- A working professional wanting long-term security: The LIC Jeevan Labh Plan ensures that you have a safety net while also building wealth over time. It’s perfect for those looking for financial independence and risk-free returns.

- A parent planning for your child’s future: With its maturity benefits and bonus accumulation, this plan can be a great option for securing your child’s future education or marriage.

- A self-employed person looking for risk-free returns: If you’re self-employed and want a stable investment with life cover, this plan offers a dual benefit of protection and savings growth.

Conclusion :

LIC Jeevan Labh continues to be a dependable and flexible plan for 2025. With guaranteed returns, tax benefits, and bonus potential, it’s an ideal choice for individuals and families seeking long-term financial security and peace of mind.

By choosing this plan, you get not only protection but also the opportunity to build wealth over time, making it a balanced addition to your financial portfolio.

You can learn more about the official LIC Jeevan Labh Plan on LIC’s website.

The LIC Jeevan Labh Plan is one of the most trusted options for long-term savings and insurance in 2025.

Need Expert Help?

Contact me today for a free 1-on-1 consultation!